Can I Get a Short-Term Aerial Application Drone Insurance Policy?

One of the biggest questions we get this time of year is “Can I only get a 6 month insurance policy instead of a full 12 month policy?” The answer is not as easy as you’d think when you compare to your home, farm, and auto policies. Let’s dive in and explore why that’s the…

Soaring into Summer: How Memorial Day Celebrations Make Ag Drones Shine

As we gear up to honor our heroes this Memorial Day, it’s not just the BBQ smoke filling the air and the flags waving in the breeze. It’s also the peaceful hum of agricultural drones zipping through fields, mapping out crops, and ensuring our farms remain productive and resilient. For those of you piloting these…

Easter and Ag Drones: A Basket Full of Innovations in Agriculture

Ah, Easter! A time to hunt for eggs, enjoy a giant chocolate bunny, and embrace the sacrifice that was made to make this day possible. But while you’re busy pretending the Egg-Delivering Bunny isn’t getting too old for the job, let’s hop into a different kind of innovation that’s transforming agriculture: Agricultural Drones. This technology…

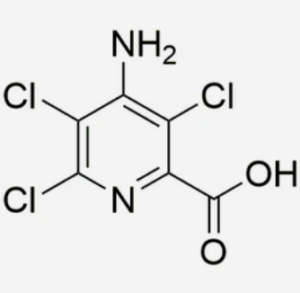

Is Picloram Included on My Ag Drone Insurance Policy?

Is Picloram Included in My Ag Drone Insurance Policy? Spoiler Alert: You Might Want to Double-Check! If you’re operating agricultural drones, chances are you’re familiar with various herbicides and pesticides flying around in your field of vision. Among those colorful bottles in your shed, Picloram might be one of the notorious names you come across.…

VT Insurance at the 3rd Annual End User Drone Conference

Join VT Insurance at the 3rd Annual End User Drone Conference! Hello, drone enthusiasts and aerial application aficionados! I’m thrilled to announce that we’ll be attending the 3rd Annual End User Drone Conference! If you thought last year was a blast, brace yourself for some high-flying fun this time around. This event is all set…

How Aviation Insurance is Different Than Home/Auto/Farm Insurance

While the basic principle of insurance—protecting against financial loss—applies across the board, aviation insurance has some key differences compared to your typical home, auto, or farm policies. These differences stem from the unique risks and complexities associated with aircraft ownership and operation. Here’s a closer look at what sets aviation insurance apart: Specialized Coverage: Aerial…

How Does The U.S. Election Effective Ag Drones (Tariffs)

How the U.S. Election Could Impact Ag Drones: Tariffs and Beyond With Trump winning the U.S. election earlier this week, it has begun generating a lot of buzz especially in the agricultural sector. While many issues are at play, one that stands out for those involved in agriculture is the impact of potential policy changes…

How Aircraft Hull Values Effects Premiums and Deductibles

How Aircraft Hull Values Affect Premiums and DeductiblesWhen it comes to insuring your aircraft, understanding how hull values influence premiums and deductibles is essential. It’s not just about getting the right coverage; it’s about finding a balance between protection and cost-effectiveness. What is Aircraft Hull Value? The “hull” refers to the aircraft itself, including its…

Spooky Aviation Insurance Facts for Halloween

Halloween is a time for chills and thrills, and while aviation might not be the first thing that comes to mind when you think of spooky season, it certainly has its share of eerie tales and surprising facts. So buckle up and prepare for takeoff as we explore some spooky aviation insurance facts that might…

What is Reinsurance and Why is it Important?

VT Insurance Agency: Your Trusted Partner for Drone and Aviation Insurance VT Insurance Agency is the leading insurance agency specializing in aerial application drone and aviation insurance. We understand the unique needs of drone and aviation operators, and we are committed to providing them with the best possible coverage at the most competitive rates. Reinsurance:…

Does My Farm Policy Cover My Drone?

Does My Farm Policy Cover My Drone? A Guide for Farmers who Own Drones As drone technology becomes increasingly popular, many farmers are turning to unmanned aerial vehicles (UAVs) to enhance their operations. Drones can be used for a variety of tasks, such as crop monitoring, livestock inspection, land surveying, and aerial application. However, farmers…

Cancelling policies and how the AgShort Rate applies

Understanding Your Policy: Cancellations and AgShort Rate Explained At VT Insurance Agency, we understand that flexibility is key. Whether you’re looking for drone insurance or aviation insurance, we’re here to provide comprehensive coverage with options that suit your needs. In this blog, we’ll explore the cancellation process and the AgShort Rate, helping you navigate these…

What’s the Difference Between an Occurrence Limit and an Aggregate?

Understanding the key terms in your insurance policy is crucial, especially when it comes to the limits of your coverage. Two terms you’ll often encounter are “occurrence limit” and “aggregate.” Let’s break down what they mean and why they’re important. Occurrence Limit Definition: The occurrence limit is the maximum amount your insurance company will pay for…

Third Party vs. First Party chemical drift

VT Insurance Agency, a leading national insurance agency, provides comprehensive coverage for all aerial application operations. Whether you’re spraying your own fields or are a custom aerial application professional, we can help you navigate the complex world of drone insurance. Understanding the Difference: Third-Party vs. First-Party Chemical Drift Chemical drift occurs when pesticides or other…

What’s the difference between hull coverage and spare parts?

Drone Insurance: Hull Coverage vs. Spare Parts What’s the difference between hull coverage and spare parts coverage? This blog post explores the key differences between hull coverage and spare parts coverage, two critical components of drone insurance policies. By understanding these distinctions, you can make informed decisions when selecting the right coverage for your specific…

Agricultural Drone Claims Process, What to expect next

Agricultural Drone Claims Process: What to Expect Next Introduction: As the season continues, so too does the need for specialized insurance coverage. There have been many claims reported this year and that makes since with all the new UAV’s entering into the market. VT Insurance Agency specializes in aerial application drone insurance and is here…

Be compliant with FAA or insurance wont be effective

VT Insurance Agency: Your Trusted Partner for Drone and Aviation Insurance Introduction: Are you a drone operator or aviation enthusiast? If so, you understand the importance of having the right insurance coverage. At VT Insurance Agency, we are dedicated to providing comprehensive and affordable drone insurance and aviation insurance solutions for individuals and businesses in…

What is the difference between Pollution and Chemical Drift?

Pollution vs. Chemical Drift: Protecting Your Business with Drone & Aviation Insurance As drones and aviation technology gain traction in a variety of industries, understanding the risks involved becomes crucial. While thrilling innovation opens a world of possibilities, it also introduces potential liability concerns for owners and operators. That’s where drone and aviation insurance from…

What is Farm-I-Tude and how can they help you fly legally today

You may have heard of the Farm-I-Tude program and how it can get your aerial application drone business up and flying legally right away; however, you may also ask yourself what is this program and how does it work. This article will give you an in depth look on how they got their start and…

The Future of Ag Drones: How Technology is Changing Insurance Needs

Agricultural drones aren’t just a cool gadget – they’re reshaping the future of farming. As drone capabilities expand, so too do the associated risks, driving the need for specialized insurance coverage. Let’s explore the cutting-edge tech and its impact on insurance. Emerging Drone Technologies • Beyond Visual Line of Sight (BVLOS):• Longer flight ranges mean…

HR 2864, What It Is and Why It’s Important

A Bill with Far-Reaching Implications for the Drone Industry HR 2864, also known as the Countering CCP Drones Act, is a piece of legislation currently under consideration in the United States Congress. This bill aims to address concerns regarding national security and data privacy by restricting the use of drones manufactured by companies tied to…

Drone Insurance Trends for 2024: What Farmers Need to Know

Agricultural drone technology develops rapidly, and the insurance landscape keeps pace. To stay ahead of the curve and protect your investment, it’s vital to understand emerging trends shaping the world of drone insurance. Let’s dive into what you need to be prepared for. Trend #1: Increasing Regulations, Increasing Coverage Needs As drone use becomes more…

Pre-Flight Checklist: What Your Insurer Wants You to Check

Think of a pre-flight checklist like a mini insurance policy for each flight. By taking a few minutes for careful checks, you’re not only improving safety but also making a potential insurance claim much smoother. Your insurer is looking for evidence of due diligence, so let’s break down what matters most. The Essential Checklist: Adjust…

Oops! Drone Crash Incident Reporting for Smooth Insurance Claims

Even the most careful pilots can experience a drone mishap. When it happens, how you handle the aftermath matters – especially when it comes to filing an insurance claim. Your insurance agent is your best friend and biggest advocate in these situations. Always call them first before turning in a claim directly to the insurance…

The Smart Farmer’s Guide to Cheaper Drone Insurance: Safety Tips That Save

Drone insurance is a must-have for aerial applicators, but premiums can add up. The good news is, your actions directly impact your insurance costs. By prioritizing safety and risk management, you can unlock more affordable protection for your agricultural drone operations. How Insurers Calculate Premiums Understanding how insurers think is key to lowering your costs.…

Weather Worries: Does Your Drone Insurance Cover Storm Damage?

As a farmer, you’re no stranger to the whims of weather. But when you add drones to the mix, stormy skies become even more worrisome. So, does your drone insurance have your back when severe weather strikes? Understanding Weather-Related Coverage Not all drone insurance policies are created equal, especially when it comes to weather damage.…

Crop Spraying Liability: When Chemical Drift Turns into a Lawsuit

Drones are revolutionizing aerial application. But even with careful planning, things can go wrong. Chemical drift, where your aerial application moves off-target, can have serious consequences for you and your neighbors. Drone insurance, specifically tailored for agricultural spraying, is crucial for mitigating these risks. Understanding Chemical Drift Chemical drift can occur due to various factors:…

Hull vs. Liability: What’s the Difference and Why You Need Both for Your Ag Drone

Agricultural drones are amazing tools, but they also come with potential risks. That’s why specialized drone insurance is a must for any farmer using this technology. Two of the most important coverage types are hull insurance and liability insurance. Let’s break down the differences and why you likely need both. Hull Insurance: Protecting Your Investment…

FAA Rules and Your Bottom Line: How Drone Insurance Keeps You Compliant

As a farmer or custom applicator using drones, you’re already keeping up with a lot – crop cycles, market trends, and ever-changing technology. Adding FAA regulations to the mix can feel overwhelming. But staying compliant isn’t just about avoiding fines; it’s about protecting your licenses and the ability to use this equipment. That’s where drone…